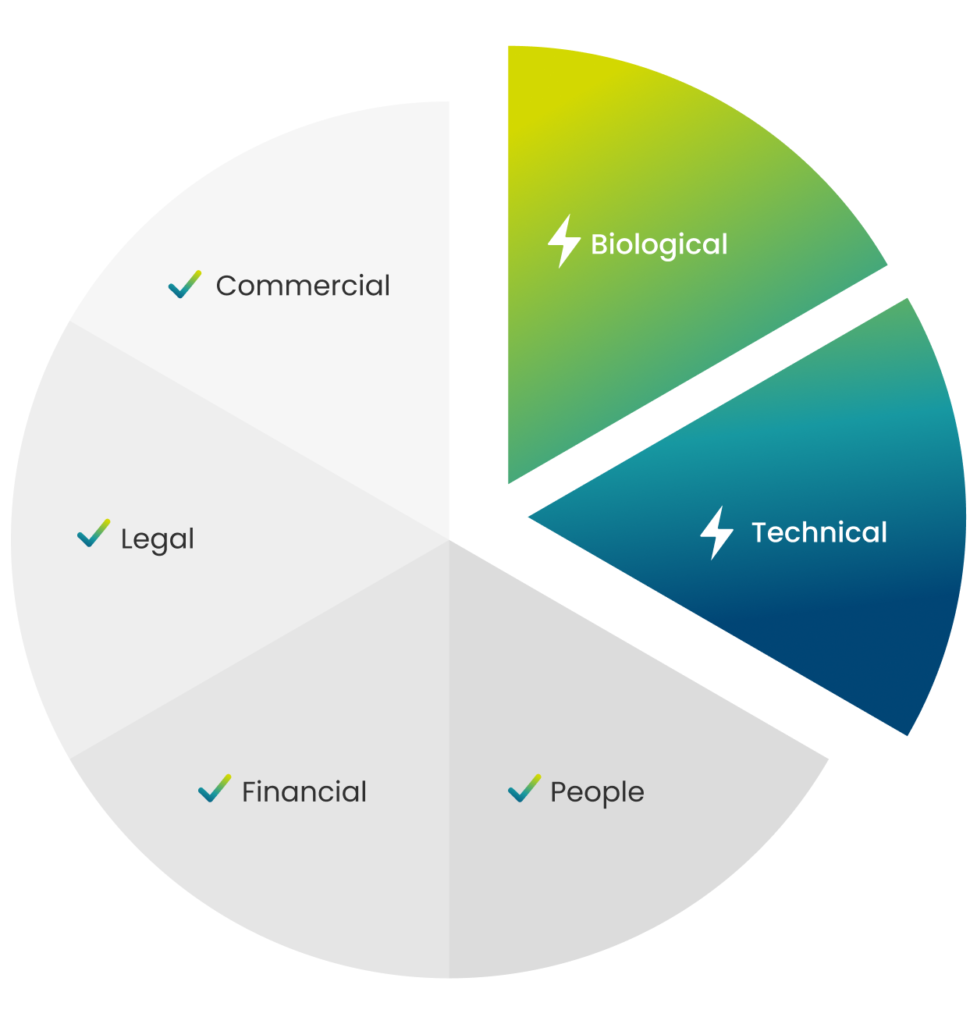

From our unique position as an independent expert in aquaculture we work as a trusted partner on a range of due diligence and scoping projects. Our strength is to combine our deep knowledge of aquaculture operations, decades of industry experience and biological expertise to give a complete package of technical insights. Our service is designed as the ideal technical complement to financial, legal and commercial due diligence.

Chris Wallard

Global Head of Xelect Ltd

Discreet & confidential

Xelect has been working in the M&A market for over 5 years providing rapid, confidential, due diligence services for a series of mergers, acquisitions and investments.

Our partners have included:

Sovereign Wealth Funds

Major international companies

Potential M&A investors

Humanitarian investment companies

Comprehensive analysis

Xelect’s review provides an overarching risk assessment of the project that highlights any key areas for concern.

Each consultancy is a fully bespoke process, that pulls on both our in-house team and our wide selection of independent industry experts.

Whatever your focus, we can provide you with the expertise you require.

Significant peace of mind

Xelect’s entire aquaculture due diligence process is designed to give you the confidence to make the right business decision.

Our risk assessments provide you with a granular level of insight, coupled with a high level overview of the current situation, areas of issue, and future scope for development.

We give you the details you need to protect your investment strategy and the assurances that you’re making a truly informed decision.

With access to a flexible team of world-class experts you can rely on us to provide you with peace of mind about your potential investments.

Arrange a call today.

Specialist genetics support to the global aquaculture industry

© All Rights Reserved. Xelect Ltd 2025

| Cookie name | Active |

|---|